M&A automation:Leveraging the domain model to map M&A data rooms, process tools easily

The domain model will consist at least of the following parts:

A data model that shows the data objects that are involved in M&A transactions and processes.

A Hierarchy of tasks in different phases of M&A Processes.

APIs for data objects and tasks.

The domain model is a programmable model. This means it is available electronically and can be navigated and displayed as you wish. It is implemented in a set of Prolog facts and rules.

Here is a first view at the phase Due Diligence. It consists of the tasks Target Due Diligence, Integration Approach Blueprint, Merger Integration Due Diligence, Deal Making and Finalize and Approve Due Diligence Business Case. Each tasks will be documented by its goals, the data objects used and a task description.Each of the data objects will be also represented in JSON notation as well as an API documentation.

Here is an example of the documentation of each task. The task Review Merger Integration Project works on concepts

Integration Project Plan, Integration Budget, Stakeholder, Integration Success, Integration Project, Integration Project Resources.It has the goal (that describes the result):

Integration project: tested and verifiedand the objectives, which describe the qualities of the result:

Integration success: maximized Quality: maximizedIt has the following task description:

We review the structure and behaviour of the merger project. It is important to remember that the word "project" means that we have a professional management of integration by professional project managers who are experienced with complex projects and equipped with the skills of a certified project manager. We should also set up a project steering committee that has comprehensive competencies and can make decisions quickly.The word "project" means that we have a project structure plan with tasks to be performed in the project. Buying companies that make frequent acquisitions have a project structure plan template that they adapt to each of the new merger integration projects. This ensures completeness and also allows a correct assessment of whether we have sufficient resources and whether the resources know what to do in the merger.But we also focus on providing answers to questions like: Do we have the right resources for the integration tasks in mergers? Are the resources able to perform the tasks assigned to them? Do the resources have adequate social skills to guide people and convince them to integrate?This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A Automation - Due-Diligence tasks: can they be automated?

How automatable are tasks in Due Diligence?

Every company is pushing the digitalization of business processes. But what about the digitalization possibilities in the M&A process. What is the current status of the automation possibilities? This article is intended to give a brief overview based on selected tasks in the due diligence phase.

Target Due Diligence

This task can be partially automated. Individual actions can be partially automated. Details can be found in the individual subtasks. Activity control is often carried out using project control applications. These can be generic tools such as MS Project or project management tools or data room application systems specialized in the management of M&A projects.

Valuation calculation of the target without synergies

This task can be partially automated. Automated tools are available for the "Calculate evaluation" action, but the data usually has to be compiled and cleaned manually.

Financial due diligence

This task can be partially automated. Usually, financial data is extracted from existing ERP solutions of the target and stored as documents in data room application systems. Evaluations of this data are performed using MS Excel or specialized evaluation calculation applications.

Legal due diligence

This task can be partially automated. Fully automated tools are available for individual actions, such as the automatic analysis of contract documents. Other actions such as the evaluation and assessment of contracts must not be automated.

Tax due diligence

This task can be partially automated. While data can be extracted from existing ERP solutions, no automated evaluation of tax information is performed.

Operations Due Diligence

This task can be partially automated. Individual actions can be partially automated. Details can be found in the individual subtasks.

Due-Diligence of the production

This task can be partially automated. The action control is usually not automated. Individual actions can be automated.

Human resources due diligence

This task can be partially automated. The analysis of contractual documents, such as employment contract templates, can be automated.

IT due diligence

This task can be partially automated. There are several automated tools for network scanning and inventory creation, as well as vulnerability scanning tools, which today often completely automate manual actions.

Due diligence of intellectual property

This task can be partially automated. There are automated tools for individual actions, e.g. for scanning contracts, which today often completely automate manually executed actions.

Cultural due diligence

This task can be partially automated. The analysis of the sentiment of employees and former employees on social networks and rating portals can be automated. The action "Survey of the cultural status of the target" can be automated.

Business model due diligence

This task can be partially automated. There are tools for semi-automated creation and management of business models. The action "Check the business model" can be automated, but is usually not performed automatically.

Due diligence of the target strategy

This task can be partially automated. However, there are only a few actions for which tools are available. Since strategies today are usually not managed and updated in application systems, automated analysis and evaluation is difficult.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A Automation: Due-Diligence of the culture - how can it be automated?

Due-Diligence of the target strategy

Why a task definition?

To enable digitization, we have to define tasks in the M&A process in detail. We use goals and objectives, a description of the task and data objects used by the task. In addition, we list questions used during execution of the tasks to provide more context. In addition we can have a look at the automatability of the task and the automation in practice. That will show us the automation potential we have today. More details will be published in my new book “Foundations of digitization for M&A processes: The Due Diligence Phase“.

The task has the following goal(s):

Target strategy: analyzed

The task has the following formal objectives:

Information asymmetry: minimized

Quality: maximized

Automation capability

This task can be partially automated. However, there are only a few actions for which tools are available. Since strategies today are usually not managed and updated in application systems, automated analysis and evaluation is difficult.

Task description

While the market analysis and the evaluation of potential commercial synergies dominate in the current literature for strategic due diligence , the market analysis and evaluation in our approach is carried out in the GTM due diligence. Hence, a different approach for strategic due diligence is to be taken. The core of the considerations is exclusively the strategy of the target. Assumptions, strategic goals and measures are determined and analysed. The relationship between the business model and the operations model is considered. In comparison to the buyer strategy, the complementarity of the target strategy with the buyer strategy is established. Any strategic risks are identified and evaluated.

The task works with the following data objects:

Target Strategy, Strategic Goal of the Target Company, Strategic Measure of the Target Company, Assignment of Strategic Measures and Goals of the Target Company, Hierarchy of Strategic Goals of the Target Company, Strategic Risks of the Target Company, Strategic Assumptions of the Target, Buyer Strategy, Strategic Measure of the Buyer Company, Assignment of strategic measures and objectives of the buyer company, strategic risks of the buyer company, strategic assumptions of the buyer, strategic objective of the buyer company, hierarchy of strategic objectives of the buyer company, draft of the strategic integration plan, strategy, complementarity of the strategy, strategic synergy.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A Automation: Tax Due-Diligence - how digitized is it today?

Tax Due-Diligence

Why a task definition?

To enable digitization, we have to define tasks in the M&A process in detail. We use goals and objectives, a description of the task and data objects used by the task. In addition, we list questions used during execution of the tasks to provide more context. In addition we can have a look at the automatability of the task and the automation in practice. That will show us the automation potential we have today. More details will be published in my new book “Foundations of digitization for M&A processes: The Due Diligence Phase“.

The task has the following goals:

Tax aspects of the target: analyzed

Draft tax integration plan: prepared

Tax effect of the financing concept: analysed

Tax clause in acquisition agreement: prepared

The task has the following objectives:

Risk: minimized

Quality: maximized

Information asymmetry: minimized

Digitization capability

This task can be partially automated. Although data could be extracted from existing ERP solutions, documents are placed in the data room and no automated analysis of tax information is performed.

Task description

Within tax due diligence, we check hypotheses about all tax-relevant transactions of all companies of the target in all countries. This audit is usually carried out by external lawyers and auditors. Besides the examination of tax aspects, such as corporate income tax and trade tax, tax risks are also considered. The result of the tax audit is used to design the tax clause in the acquisition contract. Furthermore, the acquisition financing is analysed and designed with regard to its tax effects. Any actions to be planned with regard to tax aspects are recorded in the draft tax integration plan.

The task works on the following data object types, among others:

Results of the tax due diligence of the target, draft tax integration plan, target company, tax aspects of the target, legal aspect of the target taxes, tax aspects, tax aspects of the target, tax risk of the target, tax clause in the acquisition contract, taxation of the acquisition project Tax effect of the financing concept, tax aspect of the target IT service contract, tax aspect of the application contract of the target, tax aspect of the target hardware contract, tax aspect of the termination contract of the target, tax aspect of the employment contract of external employees of the target Tax aspect of a target patent license, tax aspect of target social security, tax aspect of target IP assignment.

Questions concerning the execution of the task

The task is performed with the following questions, among others:

Does a tax planning exist?

Were the tax returns submitted correctly and on time?

Does the target company have tax advantages? Will they be affected by this transaction?

What do the seller's annual, quarterly and (if available) monthly financial statements for at least the last three years tell us about its financial performance and condition?

Are the seller's financial statements audited, and if so, for how long? Does the audit report contain a "going concern" qualification?

Do the financial statements and related notes list all the seller's liabilities, both current and contingent?

Are there internal controls for financial reporting issues?

Are the company's revenues and margins growing or declining?

Are the vendor's financial projections for the future and underlying assumptions reasonable and realistic?

How do the vendor's projections for the current year compare with the budget approved by management for the same period?

What normalized working capital will be required to continue as a going concern?

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A automation: comparing businesses of target and acquirer

REQUIREMENT: strategy, business and operations model must be covered by M&A process tools

Acquiring new business

These days, many corporates acquire other companies with new business models or are trying to integrate startups to extend the range of business models and to avoid disruption by other companies. But how do you analyze and compare businesses? Is a coarse analysis on the business model canvas sufficient to determine differences and derive activities for post merger integration? Are there any blind spots? Here are my thoughts:

Comparing businesses

In a holistic view three things describe their business of a company in a complete fashion. The strategy, the business model, and to be operational model.

The strategy defines strategic goals and measures. Strategic goals help to steer running the business, but some strategic goals also determine how to shape the business and how to create the operations for the business. I will discuss how to define and compare strategies in one of my upcoming posts, so let us focus on comparing business models and operational models.

Comparing business models

Using the Business Model Generation Methodology, you can compare two business models by comparing information from each of the model elements: value proposition,channels, customer segments, channels,revenue streams, key activities, key resources, key partners, cost structure. This gives you a set of differences on a type level, which is great. So, say, you find out that the channels are different, one is via a physical store, the other is via online store. Then you can think about leaving them separate or integrate both offerings. For department stores, we saw that combination of channels happening: buy in store, return online; buy online return in store; buy online, pick up in store.

Using the Business Model Generation methodology, you have to be aware that not only the degrees of freedom to build a business model can be the source of differentiation and disruption but also the degrees of freedom to build an operations model, which implements the business model. What is the difference? The business model is a type level model telling you what to do while the operations model is much more concrete model describing how you do it. For the department store example, the operations model would implement how you do online store ordering followed by in-store pick-up.

In addition, the strategic goals tell you how to shape the business model and the operational model. This relationship is not reflected in the Osterwalder model.

For more details on similarities of business models, please see my other blog post on elements and similarity of business and operations models

Detailing the operational model

To describe the operations model of the target and the acquirer we need details on the following core processes, their organizations and information systems:

Revenue generation and collection model or value to cash: how do we bring products to market via channels and how do we collect revenue.

Innovation processes: idea to customer value: how do we innovate.

Production operations model: supply chain to delivery.

Administration operations model: finance, controlling, facilities, HR and other administrative processes.

Keep in mind that the strategic goals and measures have to be applied to the operations model, since some of the goals help you decide how to structure the operations model. Just think about strategic goals “cost leadership” and “quality leadership”. These two goals might be operationalized by establishing operations that focus more on keeping cost low or on keeping quality as high as possible.

As we have shown here, bringing strategy, business model and operations models into one holistic model is a key ingredient for modeling a single business, but as well for comparing businesses while evaluating mergers and acquisitions. Stay tuned for more thought leadership - if you like, you can browse more thoughts on my blog page.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A Automation: Automation potential for M&A processes - how to assess it and show the tools

Digitization potential in the M&A process

How can the digitization potential be captured in the M&A process? What information is needed? These questions will be answered here.

Automation and automatability of tasks

Decisions on the digitisation of processes depend on the implementation options available. The goal is the extensive, meaningful automation of operational tasks.

Automation of tasks

To fully automate a business process, both the tasks and the coupling of tasks must be fully automated. In addition to full automation, there are other levels of automation. The automation levels of tasks can be differentiated from the external view of the tasks by the assignment of combinations of task owner types to tasks [cf. FeSi93, 178 f.].

The task owner types available are humans and machine/software (computers, robots, software). If only humans are assigned to a task, it is not automated.

If human and machines are assigned to a task, it is called semi-automated. A task is called fully automated (automated) if it is assigned only to computers, robots or software.

Figure: Degrees of automation of tasks, source: FeSi93

Automated and semi-automated tasks and the associated application systems are relevant for digitisation. Before a task can be automated, the automatability of tasks must be clarified. Only a task that can be automated can also be automated.

Automation of tasks

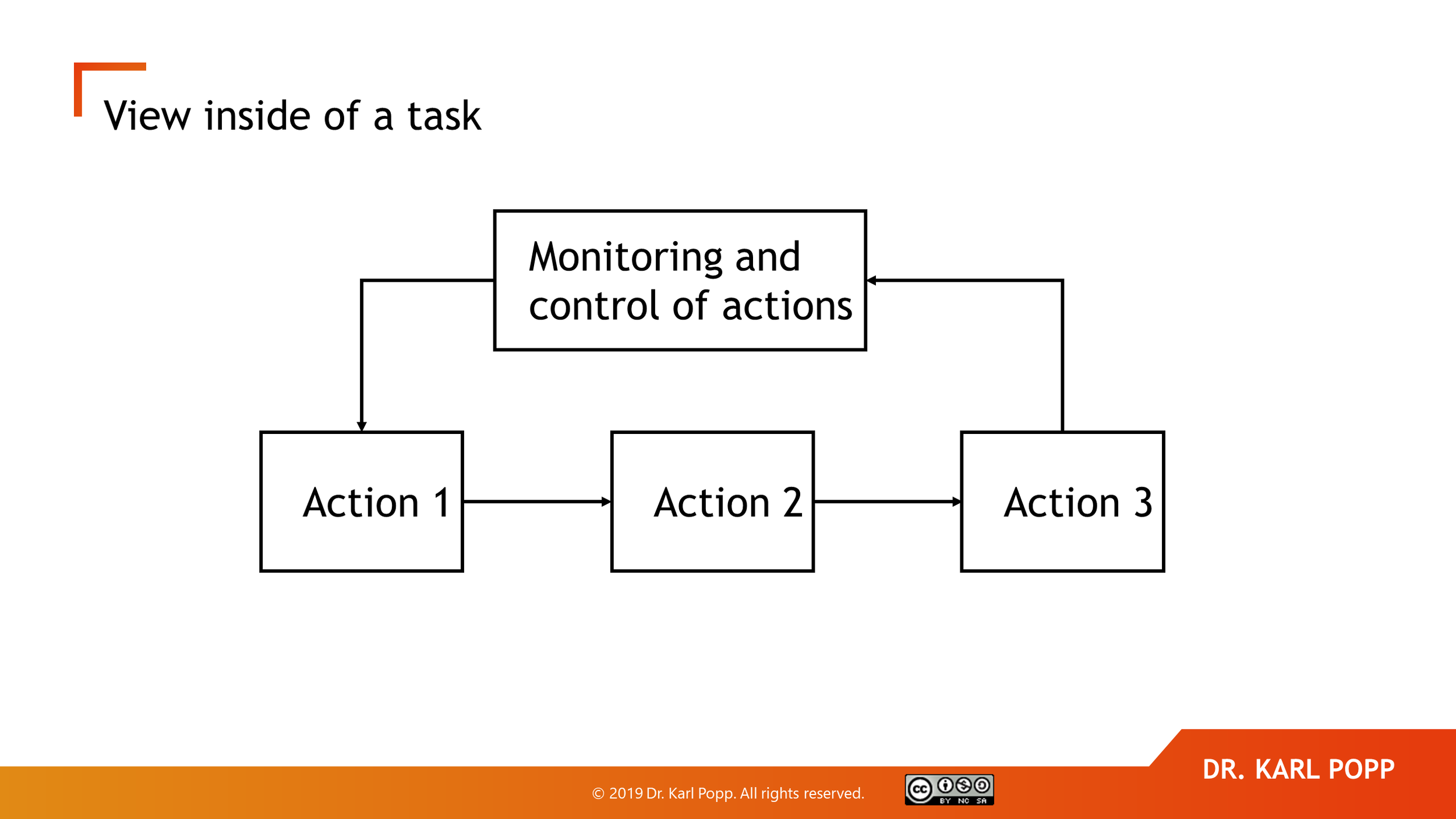

The following figure describes the execution of a task from an internal perspective. It consists of a set of actions that are linked together and monitored and controlled by an action control.

Figure: Actions and action control, source: FeSi93

Whether a task can be automated depends on the properties of the inside view of a task. To be more precise: the automatability can be described by the automatability of all actions and the action control.

If the inside view can be functionally described, the task can be fully automated. At the current state of the art it is also possible to automate tasks that cannot be functionally described (so-called decision tasks).

With the increasing availability of machine learning, the automation of decision tasks increases. Many decision tasks, which in the past could only be performed by personnel, can now be fully automated. An example is an automated analysis of contract texts for certain features. Action control can also be at least partially automated today. Workflow systems, project control software or even data rooms with action control are available for process and action control.

Digitalisation potential in the M&A process

A digitization potential for a task exists if the degree of automation of the solution process is lower than the automation capability of the solution process. The same applies to task coupling.

The digitization potential for the M&A process is the sum of the digitization potential of all tasks and task linkages.

Requirements for the reference model regarding tasks

The reference model is to describe the tasks, their automatability and show exemplary automation possibilities in the form of software (tools). This enables companies to determine the digitalization potential in the M&A process.

Displaying the tasks together with tools to automate could look like this:

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

Due diligence of intellectual property in the software industry: Definition of the task for digitization

Task Due diligence of intellectual property

Why a task definition?

To enable digitization, we have to define tasks in the M&A process in detail. We use goals and objectives, a description of the task and data objects usedby the task. In addition, we list questions used during execution of the tasks to provide more context.

Goals and objectives of the task

The task has the following objective(s):

legal IP rights: analysed

Draft IP integration plan: prepared

The task has the following formal objectives:

Risk: minimized

Quality: maximized

Information asymmetry: minimized

Task description:

In a holistic IP due diligence, the portfolio of intellectual property rights, the target's relations to all IP sources and the different types of current and future use of intellectual property are examined. For all existing and future uses of all target products and services, the following must be identified: all intellectual property rights and obligations, subsidiary measures, associated fees and payments, compliance processes, potential and existing litigation and infringements in connection with the target and its products and services. All of these shall be reviewed and evaluated to ensure that the Target owns the intellectual property to be sold, as well as third party intellectual property rights of use, and that existing and future uses of the intellectual property are consistent with the IP rights of the Target. In the software industry, the focus is usually on the intellectual property and technical due diligence of software products with respect to, for example, the architecture and quality features of the software products and the cloud service providers and web services used. The open source components and third-party products used in the product are also analyzed.

Questions used when performing the task

The task is performed with the following questions:

Has the software provider taken sufficient measures to ensure that work results of employees and service providers are IP of the target?

Which patents, trademarks, copyrights, title protection and ancillary measures exist and have been taken by the software vendor

What intellectual property clauses are included in customer contracts and cooperation agreements to ensure that none of the intellectual property rights or trade secrets of the target company are "lost"?

What intellectual property of third parties (e.g. open source software) has been and is being used by the Target and does the Target have the corresponding rights of use?

For each supplier relationship, is it ensured that the Target has sufficient rights to use third party intellectual property rights that are consistent with the existing and future forms of use intended by the buyer?

Data objects of the task

The task works on the following data object types:

draft IP integration plan, intellectual property, brand, trademark, trademark authority, legal aspect of a brand or trademark, IP licensing agreement, legal aspect of an IP licensing agreement, licensing agreement to partner, legal aspect of licensing agreement to partner, legal aspect of patent license, third party patent, patent license, IP assignments of the target, patent, patent authority.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A automation: Definition of the task "IT due diligence"

Definition of the task IT Due Diligence

Why a task definition?

To enable digitization, we have to define tasks in the M&A process in detail. We use goals and objectives, a description of the task and data objects used by the task. In addition, we list questions used during execution of the tasks to provide more context. In addition we can have a look at the automatability of the task and the automation in practice. That will show us the automation potential we have today. More details will be published in my new book “Foundations of digitization for M&A processes: The Due Diligence Phase“.

Goals and objectives of the task IT Due Diligence

The task has the following goals (planned results):

Draft IT integration plan: prepared

IT infrastructure of the target: analysed

Application systems of the target company: analysed

The task has the following objectives:

Information asymmetry: minimized

Integration success: maximized

Risk: minimized

Automatability and automation

While this task can be semi-automated, the level of automation in practice is usually low

This task is semi-automatable. There are several automated network scanning and inventory creation tools as well as security vulnerability scanning tools that fully automate actions that often are carried out manually today.

In practice, this task is usually not automated, not even in parts.

Task description

The IT due diligence includes the analysis of IT resources as well as application systems and communication systems of the company. In addition, IT costs and IT budgets are analyzed and the projects planned and running in IT are sifted and analyzed. Security aspects of the target IT are analysed and the risk of the applications, infrastructure and IT projects is assessed. Complementarity and potential synergies between target and buyer IT are evaluated.

The task works on the following data object types

Information technology of the target company, resources for automation of information systems of the target, application systems of the target company, IT infrastructure of the target, risk of the application systems, risk of the IT infrastructure, target IT projects, processes of the target IT, target IT strategy, target IT budget, target IT costs, Target IT Policy, Target Company Hardware, Target Hardware Contract, Legal Aspects of the Hardware Contract, Target IT Software Contracts, Legal Aspects of Target IT Software Contracts, IT Applications, Target Production Application System, Target Application System for Hiring New Employees Payroll application of the tar-gget, application for assessing employee performance, risk of application systems, risk of IT infrastructure, risk of application systems, risk of IT infrastructure, IS automation complementarity, IS automation synergy, resources for automation of information systems of the buyer company, Draft IT integration plan, buyer company information technology, buyer IT projects, buyer IT strategy, buyer IT budget, buyer IT costs, buyer IT costs, buyer company application systems, buyer IT infrastructure, buyer IT processes, buyer IT policy,

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A Automation: Finding potential acquisition targets

Findin potential acquisition targets - a task definition

Why a task definition?

To enable digitization, we have to define tasks in the M&A process in detail. We use goals and objectives, a description of the task and data objects used by the task. In addition, we list questions used during execution of the tasks to provide more context. In addition we can have a look at the automatability of the task and the automation in practice. That will show us the automation potential we have today. More details will be published in my new book “Automation of M&A: Due Diligence Tasks and Automation“.

The task has the following goal(s):

Longlist of targets: created

The task has the following objectives:

Information asymmetry: minimized

Automatability

This task is partially automatable.

Tools are available.

Task description

Finding targets requires a selection of the righ sources, ad definition of selection criteria followed by detailed walkthrough of target candidates and decision which candidates make it onto the longlist of potential targets. You can look for acquisition targets in the company ecosystem, e.g. partners, suppliers and in adjacent markets.

The task consists of the following actions

Define selection criteria and market

Scan sources for potential targets

Review candidates

Decide longlist

The task works on the following data object types, among others:

Target company, Target company, Target locations, Buyer, Longlist of targets, Ecosystem, Product of the target, Sales of the target, Target employees, Target business model.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A automation: Definition of the task "Design of the merger integration project"

Design of the merger integration project

Goals and objectives

The task has the following goal(s):

Draft integration project plan: prepared

The task has the following objectives:

Integration success: maximized

Synergy: maximized

Risk: minimized

Automatability

This task is partially automatable. Project planning applications are available for the actions "Plan and simulate project" and "Calculate critical path".

Task description

It is important to remember that the term 'project' implies that we have professional management of the integration by professional project managers who have experience with complex projects and are equipped with the skills of a certified project manager. The term 'project' also implies that we have a work breakdown structure with tasks to be performed in the project. Buying companies that make frequent acquisitions have a work breakdown structure template that they adapt to each of the new merger integration projects. This ensures completeness in terms of coverage of all integration topics and also allows us to assess whether we have sufficient resources and whether the resources know what to do in the integration. In this task, the sequence of integration activities is recorded in the integration project plan. It determines when the individual integration steps can be performed and whether enough resources are available to perform them at that time. The dependencies between the individual integration activities and the resource situation are taken into account. Critical paths are analyzed. IT integration activities play a special role here, on which many other activities depend. Possible risks are listed in the integration plan risks, mitigations are planned and the risks are tracked in the following integration project.

The task works on the following data object types, among others:

Integration project, Integration project plan, Integration Plan Risk, Integration budget, Draft integration project plan, Integration project resources, Organizational plan of the target, Buyer organization, Draft financial integration plan, Task of the draft integration plan for culture, Draft strategy integration plan, Draft production integration plan, Draft plan for future personnel costs, Mapping target jobs to NewCo job descriptions, Draft HR communication plan, Draft HR onboarding plan, Draft HR Training Plan, Draft culture integration plan, Draft tax integration plan, Draft Business Model Integration Plan, Draft Operations Integration Plan, Draft technical integration plan, Draft GTM integration plan, Draft IP Integration Plan, Draft HR Integration Plan, Draft Legal Integration Plan, Draft integration plan for partnerships, Draft IT integration plan, Draft integration plan.

Questions for the execution of the task

The task is executed with the following questions, among others:

Do the subprojects of the integration project cover all aspects of the integration plan?

Which time-based dependencies exist between the sub-integration plans?

Which sequence-based dependencies exist between the sub-integration plans?

Does the chronological sequence of integration activities make sense?

Have all stakeholders of the integration project and their involvement been defined?

How do we motivate stakeholders of the integration project?

How do we motivate key players in the integration project?

How do we award stakeholders and key players in the integration project?

Are we planning to celebrate milestones and successes in the integration project and when?

Are all required resources available at the appropriate time?

Does the load of integration activities at any time adversely impact the NewCo business operations and results?

How do we avoid work overload of key players in the integration project?

What time delays do we expect in the project?

What is the effect of co-determination on project progress?

Were different scenarios of time shifts in individual subprojects, especially IT integration, simulated?

How do we react to any unplanned changes during the project, such as massive price reductions in the sales markets, a pandemic or an economic downturn?

Which integration activities should start before day one and how and who does execute them?

What are the conditions to declare that the integration is completed?

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

Automation of M&A: Automation of Designing merger integration plans

REQUIREMENT: merger automation needs task definitions

Design of merger integration plans

While due diligence and dealmaking is well structured domain, the creation and successful executon of merger integrations needs structure and knowledge to be available. Let us have a look at the task of designing merger integration plans, its description and the many questions you should ask when creating such plans.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“. Out soon.

The task has the following goal(s):

Draft integration plan: prepared

The task has the following objectives:

Integration success: maximized

Synergy: maximized

Risk: minimized

Automatability

This task is partially automatable. Project planning applications are available for the 'Design Plan' action.

Task description

The integration plan is created on the basis of the individual integration plan drafts. The drafts for the individual sub-project plans generated in the target due diligence are reviewed and supplemented. The dependencies between the individual integration activities and the resource situation are taken into account. The integration budget required to carry out the project is planned and any risks and their mitigation are documented.

The task works on the following data object types, among others:

Integration project, Integration project plan, Integration Plan Risk, Integration budget, Draft integration project plan, Integration project resources, Organizational plan of the target, Buyer organization, Draft financial integration plan, Task of the draft integration plan for culture, Draft strategy integration plan, Draft production integration plan, Draft plan for future personnel costs, Mapping target jobs to NewCo job descriptions, Draft HR communication plan, Draft HR onboarding plan, Draft HR Training Plan, Draft culture integration plan, Draft tax integration plan, Draft Business Model Integration Plan, Draft Operations Integration Plan, Draft technical integration plan, Draft GTM integration plan, Draft IP Integration Plan, Draft HR Integration Plan, Draft Legal Integration Plan, Draft integration plan for partnerships, Draft IT integration plan, Draft integration plan,

Questions for the execution of the task

The task is executed with the following questions, among others:

Do we want to continue the target business? If so, what are the requirements and non-negotiables to keep the business running?

Do we want to continue the target business models? If so, what are the requirements and non-negotiables to keep the business models up and running?

Do the different parts of the integration plan cover all areas of the business model?

Do we plan changes to the business model of NewCo? If so how should these changes be reflected in the integration plan?

Do the different parts of the integration plan cover all areas of the operations model?

Are changes to the operations model planned? If so how should these changes be reflected in the integration plan?

How do planned synergies influence the NewCo operations model?

Do the different parts of the integration plan cover all areas of strategy?

What are our plans to communicate and implement the NewCo strategy?

What are the steps planned to convert existing strategies for target and acquirer to the NewCo strategy?

Does the production integration plan reflect the goals of the acquisition? How do we make sure we don´t disrupt overall the overall supply chain?

Are changes to the target production model planned? If so how should these changes be reflected in the integration plan?

How do planned synergies influence the NewCo production model?

What should the IT landscape at NewCo look like?

What should the application landscape at NewCo look like?

What are compliance requirements for IT at NewCo?

What changes are needed to the target and acquirer IT functions for NewCo?

What is the impact of planned synergies on NewCo IT and IT integration activities?

Are all end-to-end processes of NewCo supported by end-to-end coverage of applications?

Which data centers or cloud providers should be used and how do we establish the NewCo IT operations?

Do the different parts of the integration plan cover all areas of HR?

What is the impact of planned synergies on NewCo HR function, HR strategy and policies ?

How is employee communication planned?

How are benefits transferred from target to NewCo?

Which HR processes will be established at NewCo and in which steps?

Which HR applications for payroll, hiring etc. will be established?

How will the NewCo organization and its organizational units look like and what are the steps to establish them?

How do we plan to track employee satisfaction and feedback?

How do we intend to communicate elements of the NewCo culture?

What are appropriate steps to establish the GTM strategy, function and applications for NewCo?

What dependencies exist between the parts of the integration plan?

Which changes in the buyer and target since the due diligence are to be taken into account in planning?

What risks do we see for the implementation of the plans and how do we intend to mitigate them?

How do we plan to react to changes outside of NewCo during the implementation of the plan?

How do we plan to react to changes outside of NewCo during the implementation of the plan?

How do we plan to react to changes inside of the acquirer during the implementation of the plan?

How do we plan to react to changes regarding customers during the implementation of the plan?

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A automation: M&A data model as a sound basis for the M&A API

What is the domain model for M&A?

The domain model will consist at least of the following parts:

A data model that shows the data objects that are involved in M&A transactions and processes.

A Hierarchy of tasks in different phases of M&A Processes.

APIs for data objects and tasks.

The domain model is a programmable model. This means it is available electronically and can be navigated and displayed as you wish. It is implemented in a set of Prolog facts and rules.

Give me an example for a task in the M&A domain model

Here is an example of the documentation of each task. The task Review Merger Integration Project works on data objects:

Integration Project Plan, Integration Budget, Stakeholder, Integration Success, Integration Project, Integration Project Resources.It has the goal (that describes the result):

Integration project: tested and verifiedand the objectives, which describe the qualities of the result:

Integration success: maximized Quality: maximizedIt has the following task description:

We review the structure and behaviour of the merger project. It is important to remember that the word "project" means that we have a professional management of integration by professional project managers who are experienced with complex projects and equipped with the skills of a certified project manager. We should also set up a project steering committee that has comprehensive competencies and can make decisions quickly.The word "project" means that we have a project structure plan with tasks to be performed in the project. Buying companies that make frequent acquisitions have a project structure plan template that they adapt to each of the new merger integration projects. This ensures completeness and also allows a correct assessment of whether we have sufficient resources and whether the resources know what to do in the merger.But we also focus on providing answers to questions like: Do we have the right resources for the integration tasks in mergers? Are the resources able to perform the tasks assigned to them? Do the resources have adequate social skills to guide people and convince them to integrate?What about the data model inside the M&A domain model?

Each of the data objects used by tasks in the M&A domain model are connected in a domain data model. So let us have a look at Integration Project Plan and how it is connected in the data model. Currently the data model contains 376 data objects and many more relationships.

The data model can be used for several purposes. It is used as part of the documentation of tasks and allows a user to understand the task at hand better. Secondly, it can serve as part of a M&A domain API definition that allows to integrate several digital tools within the M&A process.

Example of a data object and its relationships

The task Review Merger Integration Project works on a data object called integration project.

on the left side you see other data objects that have relationships that are incoming. On the right side you see outgoing relationships pointing to other data objects. This data object relates to a stakeholder and an integration plan. So every integration plan has at least one integration project. The integration project might have several risks associated with it. And the integration project has an integration plan.

Since the data model contains 876 data objects, it provides a comprehensive model for implementing tools for the M&A process.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

M&A digitalization: We need a domain model for M&A

REQUIREMENT: WE NEED A DOMAIN MODEL TO MAP AND INTEGRATE DIFFERENT TOOLS

A domain model for mergers and acquisitions will save us.

The clash of domains

Two companies shall be merged. Two workforces and two administrations have to be aligned, changed and integrated. The first problem that comes up is corporate language and a missing joint domain model and integration plan for people involved but also for applications, companies, locations and countries.

Domain models

Domain models are semantic models that show objects and their relationship in a specific domain. For the M&A domain there will be representations of the M&A strategy, the business case, the integration plan and of course, of both companies to be merged. In addition we need a model of the integration project and all the tasks to be carried out in the different phases of the M&A process. The domain model does not only cover company data, but also data about the M&A process, the involved people and other attributes of the integration like goals and objectives and how they are measured.

Mapping out phases and tasks in the M&A process

Soon , the PMI workgroup of the German M&A association will publish a reference model for all tasks in the M&A process. Here is a short preview of what will be included:

Phases: are part of the M&A process like a due diligence phase or the phase between sign and close.

Tasks: describe the activities to be carried out during the M&A process. Plus there will be goals and objectives for each task that steer the execution of the tasks and measure success.

Concepts: Describe the domain data of the different companies, like companies, departments, the project management domain

Wow, that might be a lot of data types to be modeled, how can you ensure consistency? It all comes together on a task level. Tasks are executed to transform companies to reach an end state, called goal. Goals and objectives will be different by merger and companies involved.

In our case the goal is that the organizations are integrated. Success is measured with two objectives: integration success is maximized and risk is minimized.

task: execute_merger_integration_projectphase: merger integrationgoal: buyer and target organizations are integrated.objectives: integration success is maximized, risk is minimized.task description: Resources for the project will be allocated. and the integration project will be executed.concepts: target, buyer, organization, budget, project plan, resourcesDomain model APIs foster integration of tool vendors

Domain models can be used to drive transparency in the heterogenous world of M&A tools. Tool vendors can easily show the coverage of tasks within the domain model

The description of phases, tasks, concepts, goals etc. will be formalized and can be easily used to generate API descriptions that could be used to integrate different tools in the M&A process like data rooms, project management tools etc. So stay tuned for more progress.

This is an excerpt of my new book “Automation of Mergers and Acquisitions“.

CLICK OR SCAN THE QR CODE TO ORDER THE BOOK

Due-Diligence of the target strategy - can it be automated?

Due-Diligence of the target strategy

Why a task definition?

To enable digitization, we have to define tasks in the M&A process in detail. We use goals and objectives, a description of the task and data objects used by the task. In addition, we list questions used during execution of the tasks to provide more context. In addition we can have a look at the automatability of the task and the automation in practice. That will show us the automation potential we have today. More details will be published in my new book “Foundations of digitization for M&A processes: The Due Diligence Phase“.

The task has the following objective(s):

Target strategy: analyzed

The task has the following formal objectives:

Information asymmetry: minimized

Quality: maximized

Automation capability

This task can be partially automated. However, there are only a few actions for which tools are available. Since strategies today are usually not managed and updated in application systems, automated analysis and evaluation is difficult.

Task description

While in the current German literature under strategic due diligence the market analysis and the evaluation of potential commercial synergies dominate, the market analysis and evaluation in our approach is carried out in the GTM due diligence. Here, a different approach for strategic due diligence is to be taken. The core of the considerations is exclusively the strategy of the target. Assumptions, strategic goals and measures are determined and analysed. The relationship between the business model and the operations model is considered. In comparison to the buyer strategy, the complementarity of the target strategy with the buyer strategy is established. Any strategic risks are identified and evaluated.

The task works with the following data object types:

Target Strategy, Strategic Goal of the Target Company, Strategic Measure of the Target Company, Assignment of Strategic Measures and Goals of the Target Company, Hierarchy of Strategic Goals of the Target Company, Strategic Risks of the Target Company, Strategic Assumptions of the Target, Buyer Strategy, Strategic Measure of the Buyer Company, Assignment of strategic measures and objectives of the buyer company, strategic risks of the buyer company, strategic assumptions of the buyer, strategic objective of the buyer company, hierarchy of strategic objectives of the buyer company, draft of the strategic integration plan, strategy, complementarity of the strategy, strategic synergy.

You will find more content here:

Neues Buch: Methodische Grundlagen für die Automatisierung von M & A

M&A-Praktiker brauchen Lösungen für folgende Probleme in Bezug auf die Digitalisierung von M&A-Prozessen:

Es ist unklar, was genau zu digitalisieren ist. Welche Aufgaben gibt es, sind diese automatisierbar und auf welche Weise sind diese zu digitalisieren?

Das Digitalisierungspotenzial im M&A-Prozess ist unklar. Welche Aufgaben kann man digitalisieren? Das Digitalisierungspotenzial besteht in der (Teil-) Automatisierung von Aufgaben, die heute nicht automatisiert sind.

Die Digitalisierungsmöglichkeiten sind intransparent. Welche Tools sind verfügbar, um einzelne Aufgaben zu digitalisieren?

Diese Problemfelder werden im hier vorgestellten, neuen Buch adressiert und Lösungen aufgezeigt. Es enthält die wesentlichen Grundlagen der Digitalisierung von Mergers und Acquisitions.

Grundlagen der Digitalisierung von M&A

Ein neuer, neuer Ansatz für die Due Diligence.

Vollständige Spezifikation aller Aufgaben inkl. ihrer Ziele und Automatisierbarkeit.

Geschäftsmodellgetrieben. risikobewusst, frühzeitige Integrationsplanung.

Passend für alle Branchen.

Best Practices, die auf vielen Akquisitionen basieren.

Was ist grundlegend neu in diesem Buch

Es wird eine Geschäftsmodell Due-Diligence eingeführt, welche sich mit dem Geschäftsmodell des Targets und dessen Verträglichkeit mit dem Geschäftsmodell des Käufers beschäftigt.

Es wird eine Operationsmodell Due-Diligence eingeführt, welche die Umsetzung des Geschäftsmodells mit Hilfe von Ressourcen in einer Organisation betrachtet. Ressourcen können Mitarbeiter, Maschinen oder Rechner sein.

Es wird eine neue Form der Strategie Due-Diligence eingeführt, die sich mit der Strategie des Targets und seiner Verträglichkeit mit der Strategie des Käufers beschäftigt.

Bereits in der Due-Diligence werden Pläne für die Merger Integration einer Prüfung in Form einer Merger Integration Due-Diligence unterzogen.

Sach- und Formalziele für alle Aufgaben werden definiert.

Einbeziehung von Anwendungen in die fachliche Due-Diligence statt nur in die IT Due-Diligence

Zum ersten Mal wird der Versuch unternommen, ein vollständiges Datenmodell für die Due-Diligence zu beschreiben.

Somit haben Sie alle Grundlagen der Digitalisierung von Mergers und Acquisitions in einem Buch.

Klicken Sie, nennen Sie Ihre Adresse und ich schicke Ihnen das Buch versandkostenfrei für 49 Euro zu.

M&A digitization: A first glimpse of the domain model

The domain model will consist at least of the following parts:

A data model that shows the data objects that are involved in M&A transactions and processes.

A Hierarchy of tasks in different phases of M&A Processes.

APIs for data objects and tasks.

The domain model is a programmable model. This means it is available electronically and can be navigated and displayed as you wish. It is implemented in a set of Prolog facts and rules.

Here is a first view at the phase Due Diligence. It consists of the tasks Target Due Diligence, Integration Approach Blueprint, Merger Integration Due Diligence, Deal Making and Finalize and Approve Due Diligence Business Case. Each tasks will be documented by its goals, the data objects used and a task description.Each of the data objects will be also represented in JSON notation as well as an API documentation.

Here is an example of the documentation of each task. The task Review Merger Integration Project works on concepts

Integration Project Plan, Integration Budget, Stakeholder, Integration Success, Integration Project, Integration Project Resources.It has the goal (that describes the result):

Integration project: tested and verifiedand the objectives, which describe the qualities of the result:

Integration success: maximized Quality: maximizedIt has the following task description:

We review the structure and behaviour of the merger project. It is important to remember that the word "project" means that we have a professional management of integration by professional project managers who are experienced with complex projects and equipped with the skills of a certified project manager. We should also set up a project steering committee that has comprehensive competencies and can make decisions quickly.The word "project" means that we have a project structure plan with tasks to be performed in the project. Buying companies that make frequent acquisitions have a project structure plan template that they adapt to each of the new merger integration projects. This ensures completeness and also allows a correct assessment of whether we have sufficient resources and whether the resources know what to do in the merger.But we also focus on providing answers to questions like: Do we have the right resources for the integration tasks in mergers? Are the resources able to perform the tasks assigned to them? Do the resources have adequate social skills to guide people and convince them to integrate?So stay tuned for more information. One of the next blogs will talk about programming on top of the domain model.

The future of Mergers and Acquisitions - Digitization for M&A processes

The future of M&A

Assuming the highest possible degree of automation and integration of the tools, the following can be assumed: Routine activities will be largely fully automated, decision tasks will be partially automated, negotiations will be supported by digital assistants.

Effects of automation

Let us look at exemplary effects of this scenario for the approach in due diligence. Routine tasks such as data room review and reading of large numbers of documents will be eliminated by using natural language processing and forensic tools. Missing information is automatically requested based on consistency checks of the data room contents. The time and effort spent on this will be dramatically reduced. Problems that today can only be detected after a time-consuming, manual review of the data rooms are automatically determined and displayed as soon as the data room is available. In other words, these issues will be available on day one instead of weeks later.

Remaining questions regarding the content of the data room are answered with the help of chat bots. The contents of due diligence meetings between buyer and target companies are also automatically logged and matched by digital assistants with the contents of the data room and the information received in the meeting, as well as e-mails and other information, are automatically added to the due diligence knowledge base.

Benefits of merger automation

There may be many other effects of automation that are not listed here. This future scenario would have the following benefits: The quality of the due diligence results will increase because the due diligence information is fully captured and does not depend on human resources. The risks and problems available at the beginning of the due diligence phase due to automation can be analyzed and mitigated earlier and more thoroughly. This can be used to increase the quality of results or to significantly shorten the due diligence process.

This short example has given us a first insight into the expected, far-reaching effects of automating the due diligence process. Whether and how quickly we will arrive in this future is up to all of us. The human factor will still be decisive, but in a different form. Let us proceed optimistically.

The future of M&A interview

I have talked about this in an interview with Kison Patel, that you can view below.

The future of M&A

A new approach to merger automation is needed

This is why we need a new, radical approach to digitization of M&A processes. This approach is described in detail in my new book. For more information and free previews, sign up here: (we respect data privacy and will not spam you. You will get M&A- and book-related content)

Here is some interesting literature on the topic:

Digitization potential for M&A processes - more details

Details on the digitization potential in the M&A process

Let´s dig into this. First we need two terms: Automation potential and automated integration potential.

Automation potential

An automation potential for an individual task exists if the degree of automation of the solution process is lower than the automation capability of the solution process. The same applies to task coupling.

Automated integration potential

An automatic integration potential for a sequence of tasks exists exactly when the tasks are not assigned to one or more different automatic task carriers. This means that there is no integration potential for a sequence of partially automated tasks that is assigned to exactly one automatic task organizer. This sequence of tasks is integrated at most automatically.

Digitization potential

Now we can define the digitization potential. A digitization potential for the M&A process consists of the automation potential of all tasks and the automated integration potential of the process.

Current situation regarding digitization in companies

The current situation in many companies is as follows. There is a high level of personal integration for numerous tasks in the M&A process, since many tasks are assigned to exactly one team, the M&A team. There is a lack of automation of the individual tasks and even more so a lack of end-to-end, automated integration in the M&A process.

A new approach is needed

This is why we need a new, radical approach to digitization of M&A processes. This approach is described in detail in my new book. For more information and free previews, sign up here: (we respect data privacy and will not spam you. You will get M&A- and book-related content)

Here is some interesting literature on the topic:

Digitalization of M&A: how the job to be done forces a new generation of tools

REQUIREMENT: M&A PROCESS TOOLS HAVE TO BE NON-INVASIVE AND HAVE TO RESPECT THE WORK ENVIRONMENT OF THE M&A PROFESSIONAL.

What is the job to be done? The job to be done is a concept invented by Clayton Christensen in his book "Competing Against Luck: The Story of Innovation and Customer Choice". It is a new way to look at the needs of customers and why they are "hiring" a product to fulfill their needs. The key concept is to focus on the customer and to avoid the viewpoint of the product. By doing so, you get a wider view what the needs of the customers are, what the customer should hire to help him and who your real competitors are.

How does it influence tool design? As soon as you know the job to be done and the context of the customer, you are able to design a product or service that has maximum value for the customer. As mentioned in an earlier blog, the context of an M&A professional is his office, the work environment on his desk, his smartphone, desk phone and computer. An M&A process platform must respect and enhance this work environment, not add another tool. So let us use this approach to define two requirements for M&A process tools.

From tool to pain reliever: One pain i heard most from fellow M&A professionals is to fill the same data like target valuation data into several different Powerpoint presentations which have different formatting but basically should reflect the same data. So an M&A platform must store the financial data of a business case and generate data into different powerpoint templates. An end-to-end M&A process platform should have a data management component for the financial data of the transaction that can intelligently export parts of the financial model into presentation formats.

From tool to productivity boost: assistive technology helps you to perform better. The pain of the M&A professional is that he has to research market and company data, bring them together and evaluate the opportunities. How can an end-to-end M&A platform help here? Market data feeds are provided automatically for business case creation. The platform offers research as a service data feeds to accomplish that.

Summary

End-to-end platforms supporting M&A processes are the basis for the digital future of M&A processes. The job-to-be-done approach helps to define service of these platforms. These value creating services, which are built on top of this platform, help M&A professionals to get their job done.

Digitalization of M&A processes: How to integrate best of breed solutions into one M&A process platform

Requirement: We need a metamodel of end-to-end M&A processes and objects

We have to move forward quickly to disrupt existing M&A processes and get the best innovations to get to a digital M&A process. So here are my thoughts, some might be drafty, but i want to get my requirements out now to ensure we all are facing the right direction for digital M&A.

Requirement: we need several vendors to provide innovations

Can the best innovation for all phases of M&A come from one vendor only? Probably not. So how do companies get the best functionality in a unified, end-to-end M&A platform? The platform has to be open, has to have OData based APIs to allow integration with the best of breed functionality for the different phases of the M&A process.

Requirement: We need a metamodel of end-to-end M&A processes and objects

Thirty years of object modelling for businesses are paving the way to create a metamodel of M&A processes. This metamodel should contain the objects and relationships to be used in the M&A process like buyer, target, companies, which are contained in longlist, shortlist, have relationships with data rooms, documents like contracts, patents, financial data etc. etc. In addition we need

Requirement: Standardization is needed

Establishing a standard metamodel for end-to-end M&A processes is key to success. There are three ways to establish it: via the market or via standardization committees or by creating a winner takes it all market for the end-to-end M&A process platform. it will be interesting to see which vendor chooses which approach.

Requirement: An ecosystem of extensions of the end-to-end M&A process platform

Based on the standardization and the OData-based metamodel, M&A process platform vendors can start to foster an ecosystem of innovations for the M&A process. Today, we would need e.g. the following ecosystem of vendors to engage: end-to-end M&A process platform, data room vendor, company information providers, contract analysis providers, machine learning application providers etc.

Summary

With the listed requirements in place, we can move forward quickly to leverage innovations from different vendors. From my point of view, establishing a winner in the end-to-end M&A process platform market is paramount to provide massive innovation to many companies. Several large corporates in Germany are considering to choose such an M&A process platform today to streamline their operations. I will keep you posted if there is one vendor that wins the market or if there are several vendors fighting for larger marketshares at customers.

Like my way of thinking? So feel free to read my book about M&A: M&A due diligence in the software industry. Do also feel free to comment, happy to receive the feedback.