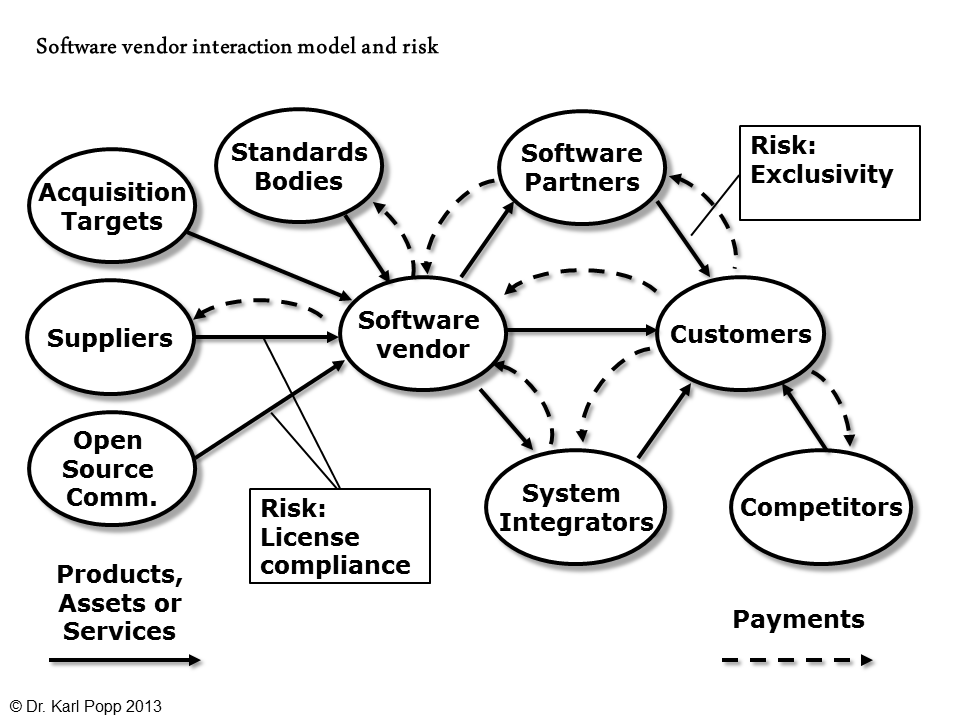

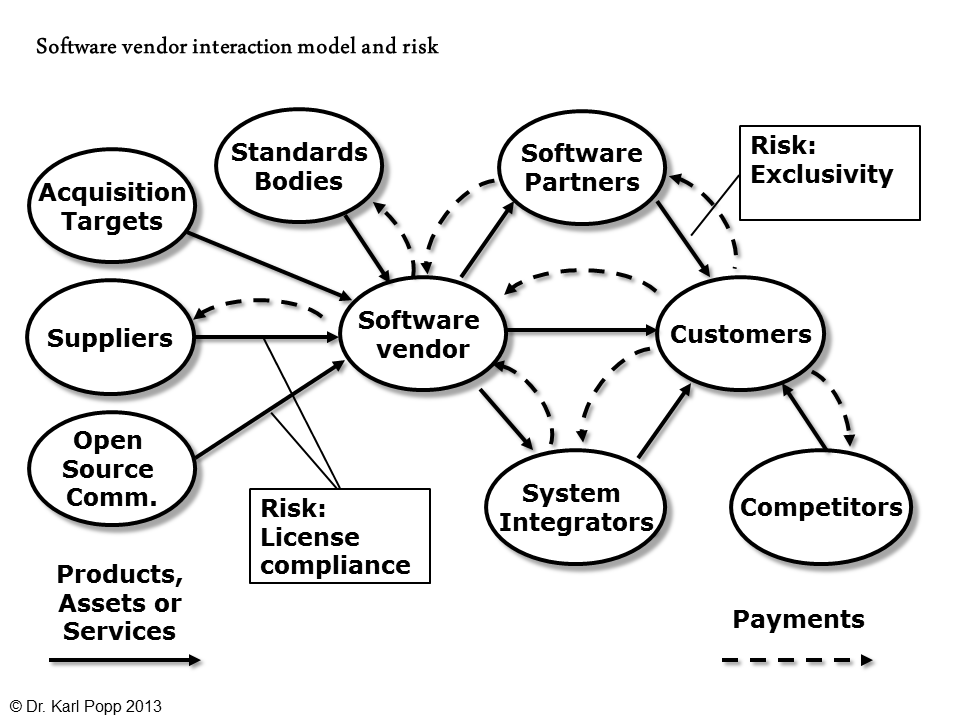

Systematic identification of PMI risks in the due diligence process

"My experience has shown that there are certain risks that can always be observed in an acquisition."

"My experience has shown that there are certain risks that can always be observed in an acquisition."