M&A Digitalization: where should data reside?

REQUIREMENT: M&A DATA HAVE TO BE STORED WHEREVER THE CUSTOMER WANTS IT: ON PREMISE, IN THE CLOUD OR HYBRID.

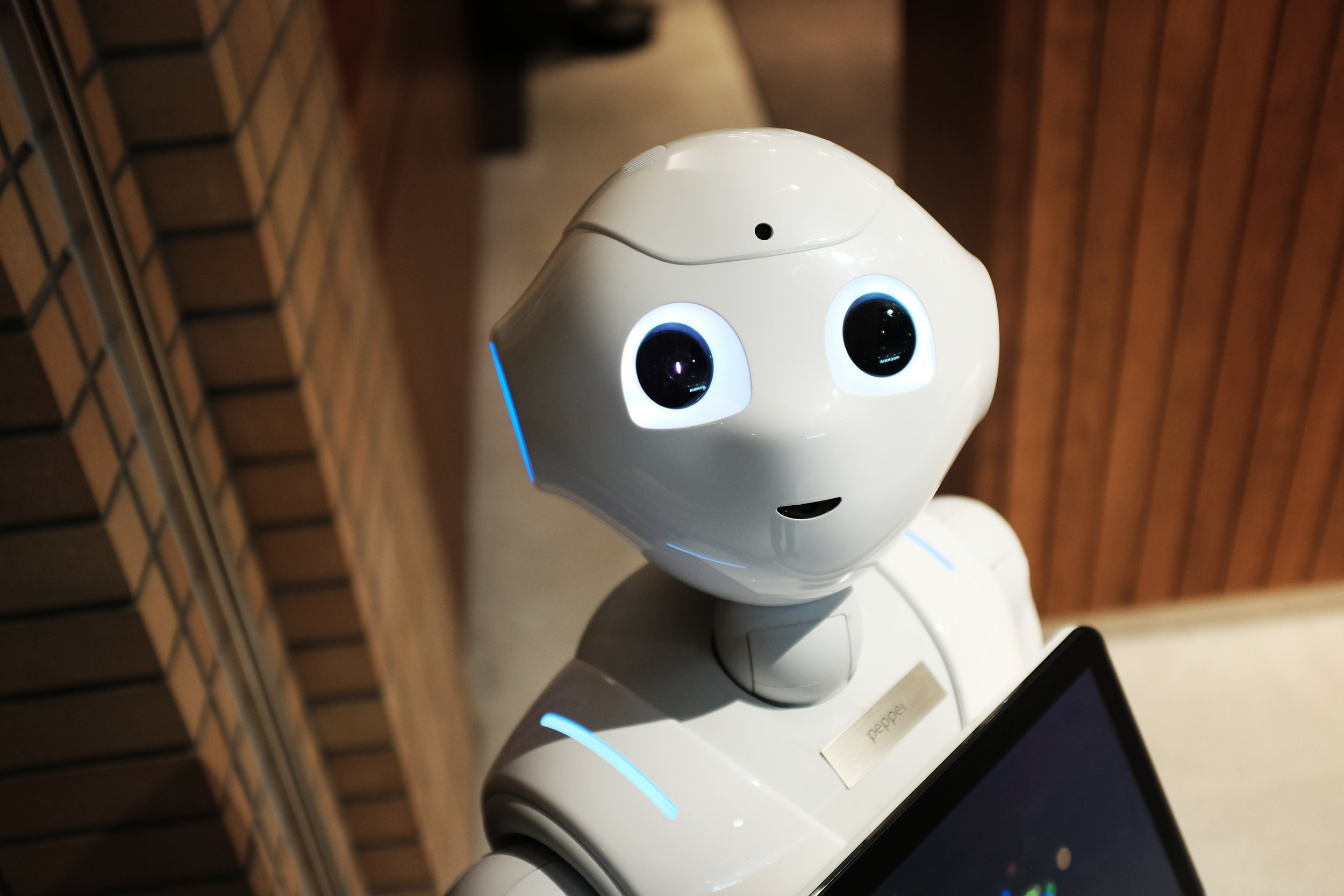

How machine learning can help in digitalization of M&A processes!

REQUIREMENT: MACHINE LEARNING HAS TO BE AVAILABLE IN ALL PHASES OF THE M&A PROCESS.

Digitalization of M&A: how the job to be done forces a new generation of tools

REQUIREMENT: M&A PROCESS TOOLS HAVE TO BE NON-INVASIVE AND HAVE TO RESPECT THE WORK ENVIRONMENT OF THE M&A PROFESSIONAL.

Digitalization of M&A processes: let´s talk about the data

REQUIREMENT: COMBINE STRUCTURED AND UNSTRUCTURED DATA FOR UNIMAGINED INSIGHTS.

Digitalization of M&A processes: Advantages of an end-to-end, unified platform

REQUIREMENT: A UNIFIED DATA LAKE FOR ALL DEALS.