M&A Target search innovation: part 3: a tale of 3 tools (MADiscover)

This blog is in the Top 25 M&A blogs worldwide according to Feedspot

At the recent M&A Summit in Munich i was asked to present my view on automation for target search, so i created a series of blogs. This is the second part covering three tools. It´s about which tools automate which parts of target search. The three tools are Palturai, Valu8 and MADiscover. Here is the information about MADiscover.

MADiscover delivers a service consisting of search and selection of companies in an iterative process based on strategic criteria without compromises. So, customers cannot access or use the tool without the service.

Unique selling point

MA Discover formally analyzes strategy and definition of strategic criteria for target search. Strategic criteria are important, so MADiscover allows for analyzing companies based on both, strategic and financial criteria.

This is one of the few tools that combine buyer acquisition strategy formalization with iterative search for targets.

Use of technology in the tool

MA Discover is only offered as a service. Machine learning is not used. Automatic language processing (NLP) is used. Advanced Analytics are used. Customer access to the tool is not possible. Analytics are used. Advanced analytics are included. Search function exists. Semantic search is provided.

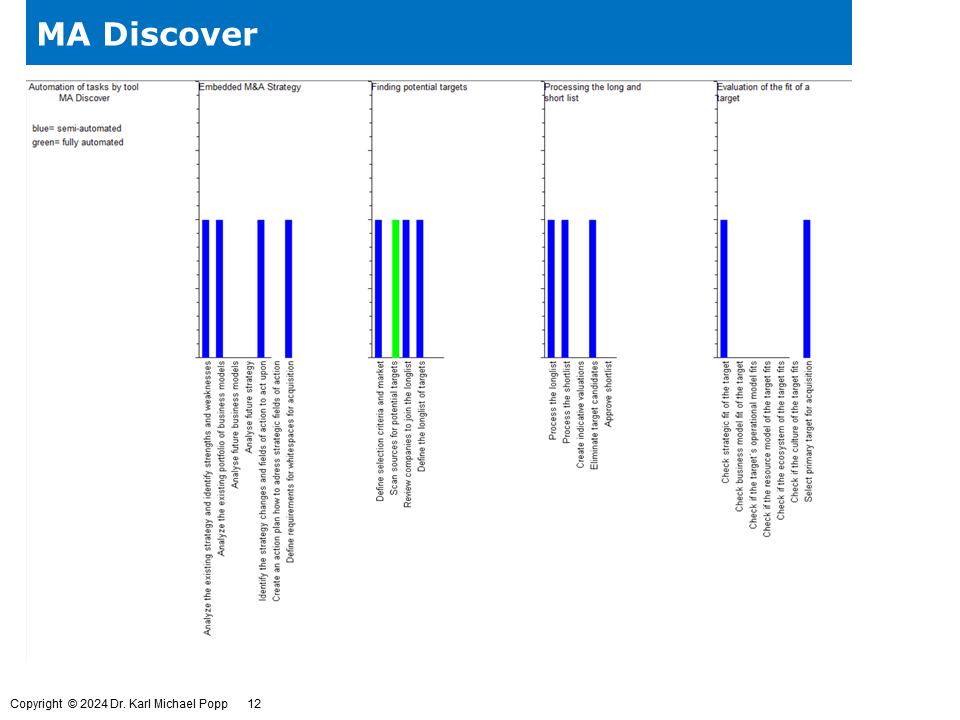

The automation is shown in the next figure

So, the tool automates the following actions

Task Embedded M&A Strategy

The tool automates the following actions

Analyze the existing strategy and identify strengths and weaknesses: partially automated.

Analyze the existing portfolio of business models: partially automated.

Analyse future business models: not automated.

Analyse future strategy: not automated.

Identify the strategy changes and fields of action to act upon: partially automated.

Create an action plan how to adress strategic fields of action: not automated.

Define requirements for whitespaces for acquisition: partially automated.

Task Finding potential targets

The tool automates the following actions

Define selection criteria and market: partially automated.

Scan sources for potential targets: fully automated.

Review companies to join the longlist: partially automated.

Define the longlist of targets: partially automated.

Task Evaluation of the fit of a target

The tool automates the following actions

Check strategic fit of the target: partially automated.

Check business model fit of the target: not automated.

Check if the target´s operational model fits: not automated.

Check if the resource model of the target fits: not automated.

Check if the ecosystem of the target fits: not automated.

Check if the culture of the target fits: not automated.

Select primary target for acquisition: partially automated.

Task Processing the long and short list

The tool automates the following actions

Process the longlist: partially automated.

Process the shortlist: partially automated.

Create indicative valuations: not automated.

Eliminate target candidates: partially automated.

Approve shortlist: not automated.

Stay tuned for more content on how tools can automate M&A. Here are the links to other parts of this blog series:

Part 1: technologies for target search

Like my thoughts? READ MY NEW BOOK

ORDER AT AMAZON

ORDER IN GERMANY

This blog contains advertising for books.